At Armory, we have the distinct honor of counting not one but two Michael Kopelmans among our ranks.

Michael 1A, as we like to call him, joined last summer as a Venture Advisor and has served as a key member of our investment committee, helping us evaluate new opportunities and follow-on investments while supporting our portfolio companies at the board level. Moving forward, Michael will be stepping into an expanded role as a Venture Partner.

I recently sat down with Michael for an interview to celebrate the occasion.

PD: I know you come to ASV from Edison Partners, where you spent nearly 20 years. Prior to that, where did your professional journey begin?

MK: I started my career in the late nineties as an investment banker with Credit Suisse in New York. I landed in their retail industry group. It was during the heady days of the internet and we were advising our large retail clients like Macy’s, CVS, and Home Depot on thinking through their direct-to-consumer strategy. In ‘99 I felt an itch to join a startup team and was recruited to E*OFFERING, an investment bank funded by General Atlantic and Softbank. It had a distribution partnership with E*TRADE and was growing rapidly. It was a very exciting time to participate in the tech boom cycle. E*OFFERING ultimately merged with a tech-focused boutique firm, SoundView, which was later acquired by Schwab.

When the market crashed, I went to Wharton to complete my MBA in 2003. That brought me back to the East Coast and I shifted my focus. My hope was to land a job in venture capital. In the summer in between my two years in business school, I interned at Edison. It was called Edison Ventures at the time. I returned to Edison after school, and remained there for nearly 20 years.

PD: Is there someone you admire who has particularly aided you in shaping your career path?

MK: My grandfather grew up in a poor immigrant family and realized the American Dream. I remember stories he told us about delivering milk in tenement buildings in New York City before going to school each day. Ultimately, he worked his way through college, becoming a successful semiconductor entrepreneur. Later in life, he become a venture capitalist well before the industry was well-understood. Back then it was far more of a cottage industry. His grit and determination continue to inspire me today. My father was a professor of management for nearly five decades and I like to think I learned a good deal about business from him over the years. It’s fair to say there is a wealth of entrepreneurship and business expertise in my family. I am always thinking about businesses, how they are oriented, how they grow and improve over time, and how exceptional teams evolve. That perspective certainly guides my thinking.

PD: What's one book you would recommend every entrepreneur read?

MK: I’m a passionate disciple of Adam Grant. I’ve read many of his books and listen to his podcast on a regular basis. They often boil down principles that are ultimately human on a fundamental level. For example, the best leaders are authentically givers rather than takers. Similarly, great leaders often curate a culture that avoids groupthink and encourages dissent. Both are qualities that are deeply valued at Armory Square. I recently read Grant’s latest book Hidden Potential, which debunks common assumptions about what drives success. The central insight is that while innate talent is valuable, it’s not as important as grit and determination.

PD: What about ASV's investment thesis resonates with you?

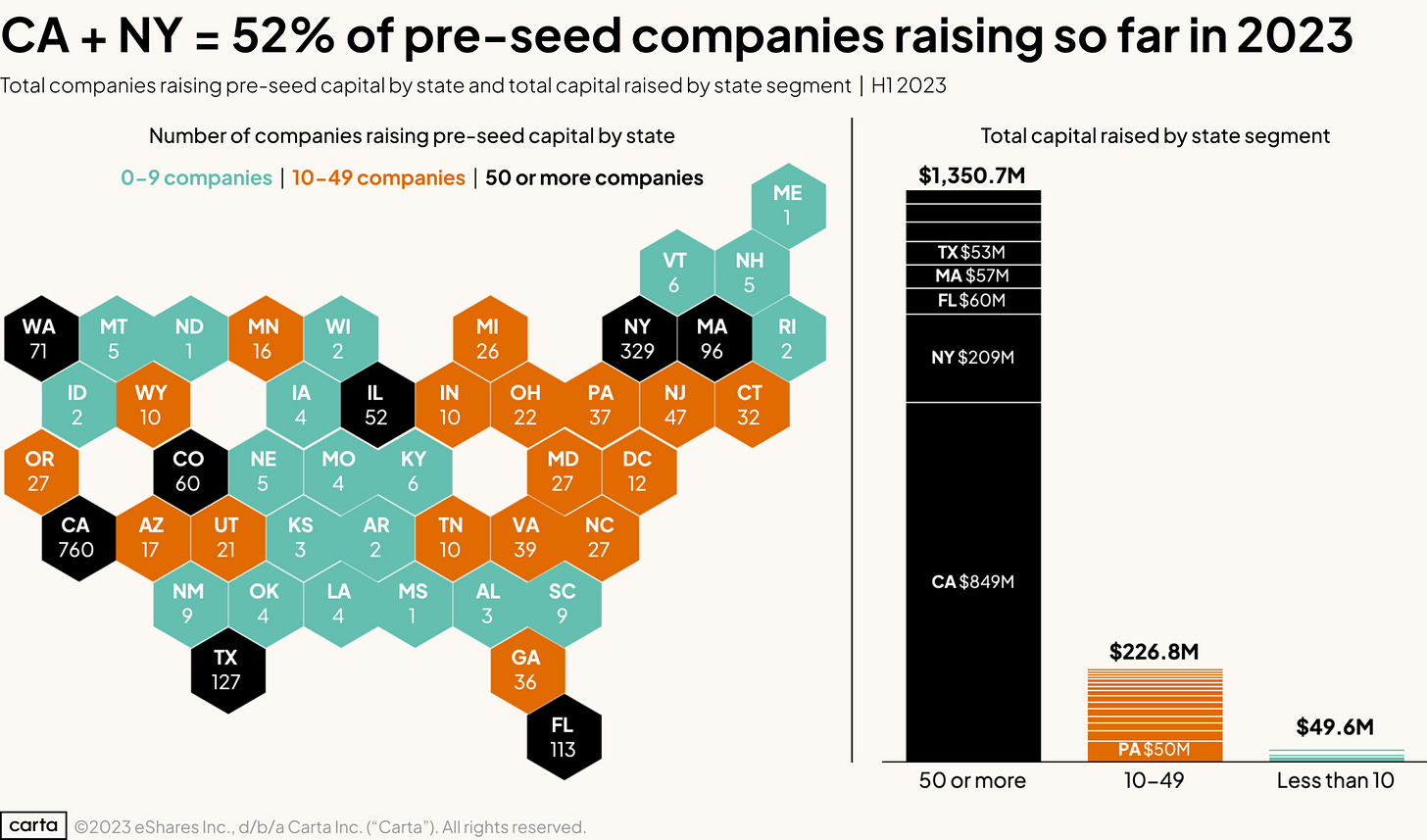

MK: Armory Square’s investment strategy reminds me of investments I made earlier in my career. I’m keen about investing in earlier-stage tech companies that have early signs of product-market fit. These companies are still refining their product and building out their management teams, but I believe there is a lot of inefficiency at the Series A stages of the startup world. Both the number of seed stage and growth/later stage investments are at an all-time high. Yet there has always been a persistent funding gap at the Series A stage. I like Armory’s “goldilocks” strategy from a risk/return perspective. Businesses at this stage are more de-risked from than the typical seed stage investment, but there are far fewer investors focusing on this segment vs. later-stage companies.

PD: How do you measure success in the early investment stages?

MK: I admire businesses that can absorb and scale capital efficiently. I often judge success based on how well a company can grow with as little capital as possible. I have rarely believed that massive amounts of invested capital are trophies to trumpet about. It’s wild to see how many wonderful companies have stymied their success by overcapitalizing their businesses. These firms have massive preference overhangs which can misalign management teams. At times, large investment syndicates struggle with competing investor priorities. In my experience companies in underserved markets tend to behave more efficiently out of necessity, often because there are fewer investors willing to travel to these markets.

PD: Interesting. Can you expand on that correlation between capital efficiency and underserved markets?

MK: Definitely. Underserved markets continue to attract less capital despite the massive fundraising boom of the past 5-10 years. And capital efficiency requires entrepreneurs to refine their business models before attempting to scale. From our standpoint, there’s also far less competition in underserved markets compared to the Metro NYC or the Bay Area. Many early-stage venture investors still want to invest in companies nearby. Barriers to investing in underserved markets have also come down, however, as investors and Boards are increasingly comfortable with virtual meetings. So, I tend to be optimistic that we will see capital flow more readily to these underserved markets in the coming years.

While there have been modest gains of investment in underserved markets, companies based in California and New York City continue to capture the lion’s share of early-stage venture investment.

PD: Historically, one of the major knocks on underserved markets has been their dearth of talent. Do you see this as a valid concern today?

MK: It’s definitely true that in the past it was more difficult to attract seasoned operators in smaller markets. However, I think the COVID experience catalyzed a chain reaction that drove many executives out of major metro areas and changed everyone’s perspectives on distributed workforces. That trend has persisted even after Covid. I’ve been impressed with how our portfolio companies have attracted experienced talent that enjoys living in underserved regions.

PD: What sectors and/or emerging technologies are you most excited by at the moment?

MK: To be honest, I’ve always been more fascinated with solving real-world problems than fixating on specific emerging technologies. I get fired up meeting with entrepreneurs who have deep domain expertise and passion about solving real-world problems that most other folks have overlooked. That’s the best part of this job: meeting people on a mission to change the world. In my view, entrepreneurs are far better at predicting the next big thing than investors. Armory Square’s particular emphasis on identifying businesses that digitize “old-line” problems also speaks to me.

PD: At Edison, you led a number of investments in the fintech sector. The public markets in this segment have taken a beating recently – are you still bullish on fintech innovation?

MK: I am incredibly optimistic. Over the last five years we saw a dramatic surge of fintech investing, which led to inflated valuations. That will likely make investment performance a real challenge. Many of these companies didn’t have reasonable unit economics or differentiated technology. Fintech is a broad category and there are pockets ripe for innovation and disruption. For example, I’m a fan of compliance solutions (which have regulatory tailwinds). We are currently evaluating an insurance solution that uses AI to make better underwriting decisions.

PD: How did you and Somak first get to know one another?

MK: Wow, it’s been a long time. Somak and I worked together nearly twenty years ago when we were both starting our venture capital careers at Edison. We would often travel together on road trips to visit companies in underserved markets. We attended several events together. I always found Somak to be exceptionally smart but also refreshingly honest and humble. He embodies the leadership qualities Adam Grant highlights in many of his books. I’m delighted to be working with him again.

PD: Outside of venture, how do you enjoy spending your time?

MK: I enjoy spending time with my family. When our kids were born, people routinely admonished me to cherish the time with them because it will fly by. I took the feedback in stride. One of the silver linings of COVID was being able to be with my family more over the past few years. It’s hard to believe my oldest son is heading off to college next year. I also love to travel and experience new cultures and cuisines. While working at Armory Square I have been exploring the Finger Lakes and captivated by its beauty.